THE Works Ministry is evaluating an “attractive” proposal submitted by Maju Holdings to take over the PLUS highway, said Baru Bian.

The works minister said in a statement that the proposal involves a significant reduction in toll rates.

and from Malaysia-Chronicle:

SAME OLD MAHATHIR? WHY CONSIDER PROPOSAL FROM MAJU HOLDINGS TO BUY OVER PLUS – IF TOLL ‘STILL APPLIES EVEN AFTER TAKEOVER’? WHAT BENEFIT CAN NEW OPERATOR BRING IF IT CANNOT COME OUT WITH IDEAS FOR ALTERNATIVE REVENUE TO SPARE THE PEOPLE FINANCIAL BURDEN?

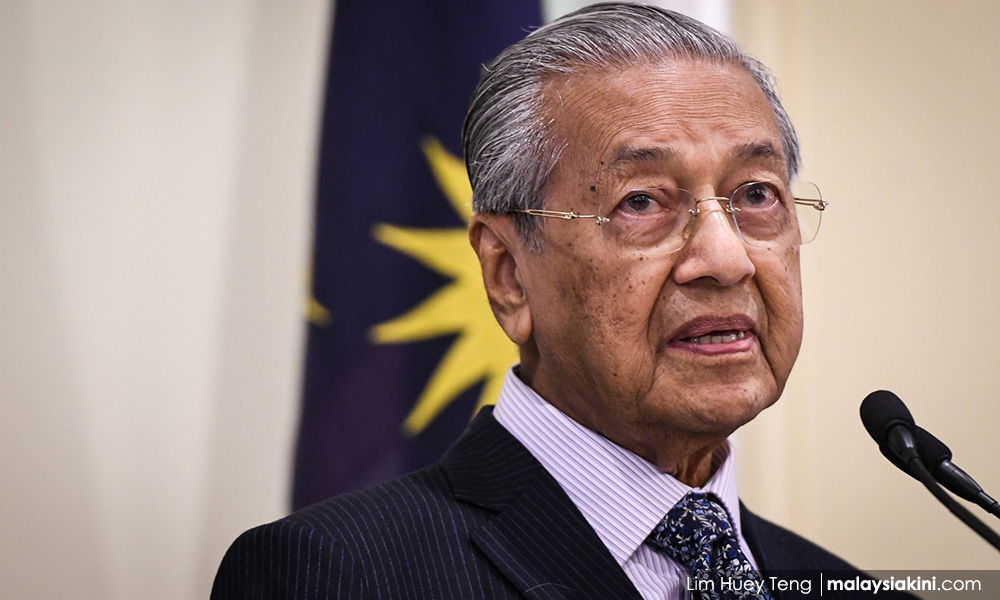

HIGHWAY toll will still apply even if the concessionaire PLUS Malaysia Sdn Bhd is taken over another entity, Prime Minister Dr Mahathir Mohamad said today.

He said the government is considering an offer from Maju Holdings Sdn Bhd to take over PLUS.

“We are looking into the proposal. They (Maju Holdings) propose that there has to be toll collection, without which they are unable to make the purchase as they will not get the returns.

“Their proposal includes a lowering of the toll rate. They want to do various other things, repair the roads… we are looking into the matter,” he told reporters after a meeting with senior civil servants in Putrajaya.

Dr Mahathir said if the government wishes to abolish toll, it has to come up with a lot of money to take over the concessionaires.

“First of all, if we don’t want to collect toll, we must buy the highway and that will cost billions and billions… and we don’t have the money.

“The other thing is, if we manage to buy, we then have to spend money to maintain the highway. So the people must understand the problem that we face,” he said.

How will the highways be maintained if toll collection is abolished, he said.

“The problem is that all highways need to be maintained, need to be enlarged sometimes, with new lanes. All this costs money.”

The government has made “no final decision” yet, he said.

PLUS operates the North-South Expressway, New Klang Valley Expressway, Seremban-Port Dickson Highway, North-South Expressway Central Link, Malaysia-Singapore Second Link, Butterworth-Kulim Expressway, and Penang Bridge.

Last month, Malaysiakini published:

Plus highway deal: Cabinet members on opposite lanes?

Maju Holdings Sdn Bhd's revived bid to take over Plus Malaysia Bhd – the biggest highway operator in the country – appears to be causing some friction in Putrajaya.

Maju Holdings had originally proposed to do so in 2017. To sweeten the deal, it offered to freeze toll prices for 20 years.

Eventually, the BN administration expressed doubt about the viability of the proposal and rejected it.

The Finance Ministry also told Parliament at the time that the government did not want to bail out Plus if things went south.

Maju Holdings is now trying its luck again with the new executives in Putrajaya.

Works Minister Baru Bian, who oversees public infrastructure, told reporters yesterday that his ministry had received the firm's fresh proposal and that the matter would be studied in cabinet.

According to The Edge Markets, Maju Holdings is offering RM3.5 billion for Plus, and will assume its debts of about RM30 billion.

The business paper also reported that the company planned to lower toll charges, between 25 percent to 36 percent, in exchange for extensions to the toll collection period, between 10 to 30 years.

It is believed that the appeal of Maju Holdings' deal is that it will eliminate government compensations in lieu of toll charge increases, and also meet political objectives of reducing toll rates gradually.

It is understood that cabinet has yet to deliberate on this.

Dr M to have final say?

However, Prime Minister Dr Mahathir Mohamad had gone on record to say that Finance Minister Lim Guan Eng was not interested in the proposal.

Lim himself had stated that Plus' two shareholders – Khazanah Nasional Bhd (51 percent) and EPF (49 percent) – are not keen.

EPF is parked under the Finance Ministry and Khazanah is parked under the Prime Minister's Department – but with the ministry represented by Shahril Ridza Ridzuan as managing director.

In a report published on July 1, The Edge Markets had asked Mahathir about Lim's opposition to the deal, to which the prime minister said: "He (Lim) doesn't want."

Mahathir also signalled his doubt over whether the government could nationalise all the highways in the country.

"It's difficult because it is going to cost a lot of money, but we don't have money," he said.

"I don't know. He (Lim) seems to think that he (the government) can take (over) the highways and charge during the rush hour (and) collect tolls.

"But I don’t know whether (this will work) for the urban highways. Yes, we will see."

This was likely in reference to the Lim-initiated experiment of nationalising four highways in the Klang Valley.

The plan was to finance the nationalisation process by levying a congestion charge.

Lim had said that this method, if successful, could be a model for the government take over of other highways.

What is Maju Holdings?

Maju Holdings is a privately-held company controlled by Abu Sahid Mohamad, who stepped down as the chair of Perwaja Holdings Bhd in 2013.

Its best-known projects are the Bandar Tasik Selatan bus terminal (BTS) and the Maju Expressway (MEX).

Most of its key infrastructure projects were won during the latter half of Mahathir's first tenure as prime minister.

The company seems rather fond of Mahathir, and regularly pays tribute to the prime minister on a digital billboard affixed to one of its skyscrapers near TBS.

Incidentally, The Edge Market's interview with Mahathir was conducted at the sidelines of Abu Sahid's Hari Raya open house event on July 24 in Sungai Besi. Baru was spotted at the same event.

Plus, which runs five highways and the Penang Bridge, is a loss-making company. Abu Sahid had told The Edge Markets that he could turn things around.

Putrajaya's intentions with Plus and other highways might become clearer in coming weeks when the cabinet finally deliberates on the report by an independent consultant commissioned by the Works Ministry.

Baru previously explained that this consultant would suggest solutions to ease the burden on highway users.

Previously, Deputy Works Minister Mohd Anuar Mohd Tahir said that this report would be tabled to cabinet in June.

Mahathir has slammed the Khazanah fund, accusing it of having deviated from the original purpose of its creation – to support Bumiputera equity in Malaysia. See also NST's Khazanah has deviated from assisting Bumiputera objective: Mahathir:

and By Leslie Lopez, The Asian Wall Street Journal (1 December 2004)

... the fund is still burdened with problems inherited from the mid-1990s, bankers and government officials say. These include a portfolio littered with bad bets such as some sour loans to Malaysian business groups and overpriced property acquisitions.

Such investments have crimped Tabung Haji’s ability to provide bigger dividends to the 4.5 million depositors who have collectively invested more than $3 billion in the fund.

The chief source of Tabung Haji’s woes has been political meddling. Documents reviewed by The Asian Wall Street Journal and interviews with Tabung Haji executives, bankers and government officials show that recommendations by Tabung Haji’s board on investment proposals were sometimes sidestepped or ignored in favour of dictates from politicians.

The chief source of Tabung Haji’s woes has been political meddling. Documents reviewed by The Asian Wall Street Journal and interviews with Tabung Haji executives, bankers and government officials show that recommendations by Tabung Haji’s board on investment proposals were sometimes sidestepped or ignored in favour of dictates from politicians.

Examples include the purchase of a centrally located office building in Kuala Lumpur and an investment in a real-estate development in Johor state. Both investments were joint ventures with Maju Holdings Sdn. Bhd., a private concern controlled by Abu Sahid Mohamed, a Kuala Lumpur businessman. Mr. Abu Sahid declined to comment for this article.

Tabung Haji also is suffering from bad loans it made to several Malaysian business groups during the go-go 1990s. For instance, the fund is the largest participant in a consortium of banks that lent 400 million ringgit to a group of private investors who control about 18% of DRB-Hicom Bhd., one of Malaysia’s largest publicly listed industrial conglomerates. The loan hasn’t been serviced for almost a year, and collateral for the credit consists of DRB-Hicom shares whose value currently covers only about 50% of the outstanding loan, according to bankers familiar with the situation. [...]

Tabung Haji also is suffering from bad loans it made to several Malaysian business groups during the go-go 1990s. For instance, the fund is the largest participant in a consortium of banks that lent 400 million ringgit to a group of private investors who control about 18% of DRB-Hicom Bhd., one of Malaysia’s largest publicly listed industrial conglomerates. The loan hasn’t been serviced for almost a year, and collateral for the credit consists of DRB-Hicom shares whose value currently covers only about 50% of the outstanding loan, according to bankers familiar with the situation. [...]

That changed in 1995 when former Prime Minister Mahathir Mohamad’s administration amended the charter to give the cabinet minister overseeing the fund’s affairs full authority over its investments. The minister in charge of Tabung Haji traditionally has been the politician overseeing Islamic affairs for the government. “That effectively rendered the board and the investment panel impotent,” contends a Kuala Lumpur-based banker close to Tabung Haji. This banker and several private economists tracking the fund say that Tabung Haji’s current troubles are strong grounds for the government to consider trimming the powers given politicians on investment matters.

Tabung Haji’s troubled joint ventures with privately controlled Maju Holdings illustrates how investment-decision making sometimes went awry.

In early 1996, Maju, an unprofitable company owned by Mr. Abu Sahid, offered the fund a 49% stake in a property-development project in the city of Johor Bahru. Maju valued the property at 137 million ringgit at the time.

Tabung Haji’s board initially opposed the proposal because of Maju’s weak financial position, according to internal Tabung Haji documents seen by The Asian Wall Street Journal. Maju was saddled with accumulated losses of about 47 million ringgit and the fund’s board feared Tabung Haji could be exposed to hefty liabilities if Maju’s Johor Bahru development faced cost overruns during construction.

Despite the board’s reservations, the then-minister in charge of Tabung Haji, Abdul Hamid Othman, directed the fund’s chairman at the time, the late Ahmad Razali Mohamed, who was Dr. Mahathir’s brother-in-law, to proceed with the investment, according to the internal Tabung Haji documents.

After Tabung Haji invested 67 million ringgit in October 1996, the project immediately ran into trouble. It has since been abandoned.

Mr. Abdul Hamid, who is currently a special adviser to the government on Islamic matters, declined to comment for this article.

A senior Maju executive describes the company’s joint venture with Tabung Haji in Johor as a “sensitive issue” with the state government. “There will be compensation from the state and we are taking steps to recover our investment,” says Fuad Yon, a director of Maju Holdings.

The troubles with the Johor project didn’t stop Tabung Haji from doing more business with Mr. Abu Sahid, however. According to internal Tabung Haji documents, Mr. Abu Sahid again approached the fund in December 1997, offering to sell it a building in a Maju real-estate development called Maju Junction in Kuala Lumpur.

To expedite the deal, Mr. Abu Sahid wrote to Mr. Abdul Hamid on Dec. 30, 1997, asserting that Tabung Haji’s backing was vital because his bank was threatening him with foreclosure on the Maju Junction property. “I desperately need your quick approval on this matter, because the bank has already issued a foreclosure notice on [the] property,” Mr. Abu Sahid wrote, without disclosing the identity of the bank, in the letter reviewed by The Asian Wall Street Journal.

Three days later, Mr. Abdul Hamid wrote to Tabung Haji’s then-chief executive officer, Harun Baba, approving the Maju Junction transaction. According to internal documents, Tabung Haji’s board agreed in a meeting in January 1998 to acquire the building after receiving an independent valuation report on the venture.

Despite the board’s reservations, the then-minister in charge of Tabung Haji, Abdul Hamid Othman, directed the fund’s chairman at the time, the late Ahmad Razali Mohamed, who was Dr. Mahathir’s brother-in-law, to proceed with the investment, according to the internal Tabung Haji documents.

After Tabung Haji invested 67 million ringgit in October 1996, the project immediately ran into trouble. It has since been abandoned.

Mr. Abdul Hamid, who is currently a special adviser to the government on Islamic matters, declined to comment for this article.

A senior Maju executive describes the company’s joint venture with Tabung Haji in Johor as a “sensitive issue” with the state government. “There will be compensation from the state and we are taking steps to recover our investment,” says Fuad Yon, a director of Maju Holdings.

The troubles with the Johor project didn’t stop Tabung Haji from doing more business with Mr. Abu Sahid, however. According to internal Tabung Haji documents, Mr. Abu Sahid again approached the fund in December 1997, offering to sell it a building in a Maju real-estate development called Maju Junction in Kuala Lumpur.

To expedite the deal, Mr. Abu Sahid wrote to Mr. Abdul Hamid on Dec. 30, 1997, asserting that Tabung Haji’s backing was vital because his bank was threatening him with foreclosure on the Maju Junction property. “I desperately need your quick approval on this matter, because the bank has already issued a foreclosure notice on [the] property,” Mr. Abu Sahid wrote, without disclosing the identity of the bank, in the letter reviewed by The Asian Wall Street Journal.

Three days later, Mr. Abdul Hamid wrote to Tabung Haji’s then-chief executive officer, Harun Baba, approving the Maju Junction transaction. According to internal documents, Tabung Haji’s board agreed in a meeting in January 1998 to acquire the building after receiving an independent valuation report on the venture.

In a letter dated May 4, 1998, Mr. Abu Sahid again wrote to Mr. Abdul Hamid informing him that Tabung Haji officials had offered to acquire the proposed building in the Maju Junction project for 266.5 million ringgit. The figure was based on a valuation of 488 ringgit per square foot for the office tower, according to Mr. Abu Sahid.

Mr. Abu Sahid suggested that the proposed transaction be “rounded to 270 million ringgit” and also requested that Tabung Haji pay an initial installment of 220 million ringgit for the purchase upon signing of a sales agreement. The balance was to be paid on the project’s completion.

Mr. Abdul Hamid wrote a letter to then-Prime Minister Mahathir on May 8, 1998, informing him of the project offered to Tabung Haji and sought the former premier’s approval to grant Mr. Abu Sahid the large upfront payment. On Mr. Abdul Hamid’s letter, Dr. Mahathir penned “approved,” together with his signature, a copy of the correspondence reviewed by this newspaper shows. In a note on May 26, Mr. Abdul Hamid informed Tabung Haji’s chairman of Dr. Mahathir’s approval and instructed the board to act on the matter. Dr. Mahathir, currently away from Malaysia, didn’t respond to requests for comment.

According to the Auditor General’s report, Tabung Haji commissioned the property-valuation unit of Malaysia’s Finance Ministry to do a valuation of the proposed office tower in the Maju Junction project before deciding to acquire the building. The Auditor General’s report states that Maju’s proposed sale price of 270 million ringgit was about 77% higher than the assessment conducted by the property-valuation unit.

Still, Tabung Haji proceeded with the purchase.

When the office tower was finally handed to Tabung Haji in September 2001, the Auditor General’s report says, a new assessment of the property revealed its actual floor space was less than 30% of the total specified when Tabung Haji agreed to buy it.

That discrepancy effectively boosted the purchase price of the building to 725 ringgit per square foot. At the time, property prices for high-quality commercial buildings in the city’s top commercial zones averaged about 490 ringgit per square foot.

Maju’s Mr. Fuad contends comparisons with other property transactions at the time don’t provide an accurate picture, saying, “We delivered what we promised to sell.”

According to the Auditor General’s report, it will take Tabung Haji 21 years to recoup its investment in Maju Junction.

When the office tower was finally handed to Tabung Haji in September 2001, the Auditor General’s report says, a new assessment of the property revealed its actual floor space was less than 30% of the total specified when Tabung Haji agreed to buy it.

That discrepancy effectively boosted the purchase price of the building to 725 ringgit per square foot. At the time, property prices for high-quality commercial buildings in the city’s top commercial zones averaged about 490 ringgit per square foot.

Maju’s Mr. Fuad contends comparisons with other property transactions at the time don’t provide an accurate picture, saying, “We delivered what we promised to sell.”

According to the Auditor General’s report, it will take Tabung Haji 21 years to recoup its investment in Maju Junction.

Toonsie has nothing new to offer Malaysia as PM7. He brain is still trapped in the 70s, 80s and 90s mindset. His ideas are all so antiquated. And his friends are also from that era, with the same old ways of doing business.

ReplyDeleteSame same and no different.

This Maju Holdings offer for PLUS is much much too big for one company, especially one that has survived in the past only via government handouts. It has red flags written all over it. All the indications of another major failure. And when it fails Abu Sahid will claim he was doing "national service" and will want to be re-imbursed....ha ha ha...

Guanee and Tony Pua need to bring Toonsie up to speed on the 21st century solutions. Start with buying over the 4 highways in the Klang Valley. Proof of Concept. If the idea works then expand to other highways.