“Malaysia’s first flying car maker saddled with RM100m accumulated losses”: Is KWAP’s investments at risk?

AN online whistleblower has waved a red flag on the financial status of the Aerodyne Group after the Malaysian drone high-flyer which was cited by Prime Minister Datuk Seri Anwar Ibrahim in his Budget 2025 speech having amassed over RM100 mil in losses as per a financial report by SCRUT-powered Interepo.

While the nation’s drone-based air mobility vehicle named Vector whose prototype was unveiled by Aerodyne at the 2019 Langkawi International Maritime and Aerospace (LIMA) exhibition has yet to be mass produced, Aliff Ahmad (@Alturkistiano) is more concerned about the involvement of public money in the Aerodyne business venture.

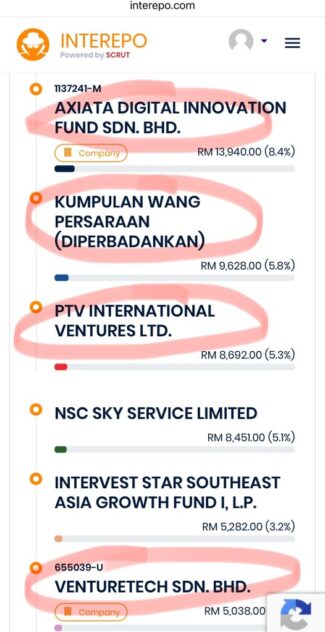

“It’s fine if the financing source is VCPE (venture capital and private equity) money from abroad. But this is money from KWAP (Retirement Fund Inc), PETRONAS Venture and VentureTech (MIGHT), all of which are basically and originally the rakyat’s money,” lamented the finfluencer a post on the X platform.

AERODYNE - SYARIKAT YANG NAK BUAT KERETA TERBANG NEGARA KINI RUGI TERKUMPUL LEBIH RM100 JUTA!! DANA PELABURAN KWAP DALAM BAHAYA??

Aerodyne dikenali sebagai syarikat yang nak buat kereta terbang pertama Malaysia. Malangnya sehingga hari ini tidak keluar lagi. Apa nama dia? Vector… Show more

“KWAP’s investment entails pension money, PETRONAS belongs to Malaysians while VentureTech belongs to the government … I don’t wish to see another FashionValet in motion.”

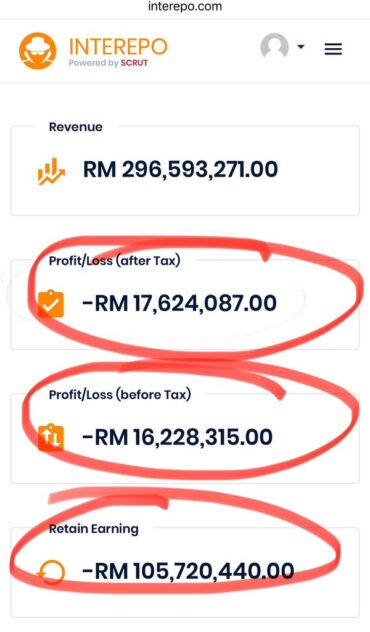

According to the financial date from Interepo, Aerodyne incurred net loss of -RM17.62 mil presumably in its latest financial year (not specified) from a revenue of RM296.59 mil while its retain earnings stood at -RM105.72 mil.

Recall that in early November, another online whistleblower FreeMalaysian (@FreeMsian) has described the world’s leading DT3 (Drone Tech, Data Tech and Digital Transformation) enterprise solutions provider.as “a high-risk investment given that the money the real owners seemed to have put in is only RM100k in ordinary shares”.

“Mostly Kamarul (owner Datuk Kamarulazman Muhamed) and his wife with few Indian nationals,” revealed FreeMalaysian. “The rest of the money of around RM300 mil seem to come from public companies, including KWAP.”

Delving further, Aliff pointed to another red flag which is that “Aerodyne has no technology”.

“If it’s just drone services for mapping, inspection, surveying and surveillance, anyone with a drone can do it today. There’s nohing exclusive and great about this,” he asserted.

“Aerodyne should (by now) have developed a technology that can be sold and used by anyone. Unfortunately, I haven’t come across any as yet. Maybe because Kamarul is an accounting graduate, not a science, engineering, technology or software guy.”

On this note, Aliff hopes that Aerodyne will quickly undertake its IPO (initial public offering) exercise “so that the shareholders can be replaced with the original government funds able to cash out and be saved”.

“Let the fans of Aerodyne buy its shares. … After that, it doesn’t matter if the company goes bust,” added the finfluencer. – Dec 19, 2024

Here u go again - another harebrained fast money grabbing scheme concocted by well connected giatuans product with the help of split tongueds!

ReplyDeleteTruly NEP - never ending profiteering at the expense of the rakyat!

If you owe the bank RM 100,000 You have a problem.

ReplyDeleteIf you owe the bank RM 100,000,000 the Bank has a problem.

Keep quiet la. Many people making money stealing from this stupid project. Talk too much also no use. Cant do anything, nothing changes. There are much bigger fish to fry. this one is kacang putih.

ReplyDelete