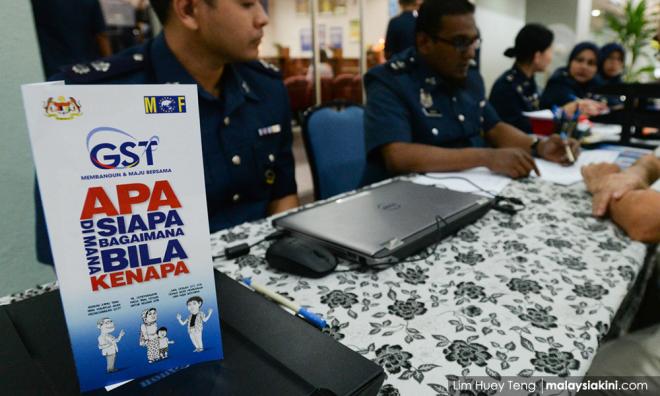

MOF sets up committee to study reintroduction of GST

The Ministry of Finance (MoF) has set up a committee to study various revenue-enhancing measures, including the possibility of reintroducing the Goods and Services Tax (GST), according to Maybank Investment Bank (Maybank IB) Research.

In a note released today following a dialogue with Finance Minister Tengku Zafrul Abdul Aziz last Friday, Maybank IB Research quoted Zafrul as saying that other measures included analysing weaknesses in the tax regime and impact of new taxation on the economy, studying options for new taxes such as carbon tax and digital tax, rationalising tax incentives, improving tax administration and enhance tax audit, such as implementing tax identification numbers and enhancing data analytics.

“Timing is also important – especially on any new taxes – so as not to disrupt the economic recovery process.

“2021 is a transition year from crisis to recovery,” it quoted Zafrul as saying.

In a note released today following a dialogue with Finance Minister Tengku Zafrul Abdul Aziz last Friday, Maybank IB Research quoted Zafrul as saying that other measures included analysing weaknesses in the tax regime and impact of new taxation on the economy, studying options for new taxes such as carbon tax and digital tax, rationalising tax incentives, improving tax administration and enhance tax audit, such as implementing tax identification numbers and enhancing data analytics.

“Timing is also important – especially on any new taxes – so as not to disrupt the economic recovery process.

“2021 is a transition year from crisis to recovery,” it quoted Zafrul as saying.

Over the medium term, Zafrul said the government is committed to lowering the budget deficit to four percent of gross domestic product (GDP) by 2023.

“The key strategy will be on revenue-enhancing given the limited scope to cut spending, such as 95 percent of operating expenditure are ‘locked-in’ obligations, like emoluments, debt service charges and retirement charges,” he was quoted as saying.

On the glove sector, afrul said that the glove manufacturers’ corporate income tax is projected at RM2.8 billion in 2020 and RM4.7 billion in 2021.

“The government decided that no windfall tax will be imposed on glove manufacturers to avoid potential 'opportunity costs/losses' such as glove manufacturing companies investing overseas instead of in Malaysia, and sending the wrong signal to existing and potential investors in other industries,” he was quoted as saying.

On the RM400 million contribution from glove manufacturers as announced in Budget 2021, Zafrul said contributions are voluntary and are on top of the glove manufacturers’ record corporate income taxes of RM2.8 billion in 2020 and RM4.7 billion in 2021.

“The key strategy will be on revenue-enhancing given the limited scope to cut spending, such as 95 percent of operating expenditure are ‘locked-in’ obligations, like emoluments, debt service charges and retirement charges,” he was quoted as saying.

On the glove sector, afrul said that the glove manufacturers’ corporate income tax is projected at RM2.8 billion in 2020 and RM4.7 billion in 2021.

“The government decided that no windfall tax will be imposed on glove manufacturers to avoid potential 'opportunity costs/losses' such as glove manufacturing companies investing overseas instead of in Malaysia, and sending the wrong signal to existing and potential investors in other industries,” he was quoted as saying.

On the RM400 million contribution from glove manufacturers as announced in Budget 2021, Zafrul said contributions are voluntary and are on top of the glove manufacturers’ record corporate income taxes of RM2.8 billion in 2020 and RM4.7 billion in 2021.

What is there to study some more? If it is good it is good. Already 500 countries have introduced it ha ha ha, the most efficient and fairest tax system, Now Everyone Can Pay Tax, like AA ha ha ha, rich or poor, tycoon or unemployed, if you breathe you pay tax, what could be more obvious than that?

ReplyDeleteAyam disappointed that the Twit of a Twat FM did not introduce it in 2021 Budget, ok lah never mind, backdoor gomen need some time, study baik-baik, can introduce in 2022 Budget....just in time for GE15....OK....? Ha ha ha....Just Do It...

Baca Baik Baik ya Tengku Twit of A Twat, kemudian Rujuk Kepada Tuan Yang Terutama Parti PAS....harap mereka boleh Halal-kan GST sebelum di-hidup kembali....ha ha ha....atau mungkin mereka boleh buat U-Turn balik kepangkuan Mercedes dan Porsche....ha ha ha lagi.....

ReplyDeleteQUOTE

Pas dakwa Majlis Fatwa Kebangsaan silap hukum GST

1 Mei 2017

ALOR SETAR - Majlis Fatwa Kebangsaan didakwa tersalah berikan fatwa mengenai hukum cukai barang dan perkhidmatan (GST) di negara ini.

Ahli Jawatankuasa Pas Pusat, Dr Mohd Khairuddin Aman Razali berkata Pas punyai sebab kukuh untuk mengatakan bahawa GST itu haram.

"Terdapat tiga sebab utama jika kerajaan ingin mengenakan cukai kepada rakyat iaitu pertama, jika pendapatan negara kurang.

"Kedua, jika pendapatan negara kurang bukan disebabkan oleh ketirisan yang berlaku di negara dan yang ketiga, cukai harus dikutip dari orang kaya sahaja.

"Maka, disebabkan syarat ketiga ini yang dilihat bercanggah dengan pendirian Islam.kerana pelaksaan GST itu merangkumi semua pihak,"katanya ketika ucapan penggulungan pemimpin Muktamar kali ke-63, di Kompleks Pas Kedah, Kota Sarang Semut.

Sebelum ini, Ketua Pengarah Jabatan Kemajuan Islam Malaysia (Jakim), Tan Sri Othman Mustapha berkata, sebelum GST dilaksanakan, banyak kajian telah dijalankan secara terperinci untuk terperinci untuk melihat tahap keperluannya.

Menurutnya, pelaksanaan GST adalah untuk memenuhi tujuan ekonomi, sosial dan kepentingan rakyat meliputi aspek kesihatan, pendidikan, rekreasi, kebajikan serta keselamatan, justeru, kerajaan dibenarkan mengutipnya untuk memenuhi kepentingan umum.

Tambahnya lagi, dasar GST ini tidak bertepatan dengan Islam dan meminta agar kerajaan membatalkannya.

"Ada yang bertanya, cukai apa yang boleh dikenakan pada rakyat jika bukan GST.

"Di sini kami berikan cukai-cukai yang boleh dikenakan khas buat orang kaya iaitu cukai simpanan korporat dan cukai jual beli saham," katanya lagi.

Justeru, beliau mendakwa Pas tetap dengan keputusan mereka mengatakan GST itu adalah haram.

"Ingin saya tegaskan di sini bahawa Pas konsisten dengan pendirian, GST patut dihentikan,"tambahnya lagi.

UNQUOTE

Tax, Tax, Tax, Tax.

ReplyDeleteJust make sure you understand that wealth has to be created first before it can be redistributed.

The Melayoo government is perpetually stuck in the mindset of redistributing wealth without thinking about where the income comes from in the first place. And perpetually promoting the politics of Envy.

it seem nothing work in this govt except applaud themeselves a malay govt wakaka.

ReplyDeleteThe Backdoor government must make sure the huge amount of tax liability owed by Najib, Rosmah and Sons are recovered before they come back to Korek more from Rakyat.

ReplyDelete