Goldman Sach's 'surprise' suit seems like diversionary tactic, says 1MDB taskforce chairman

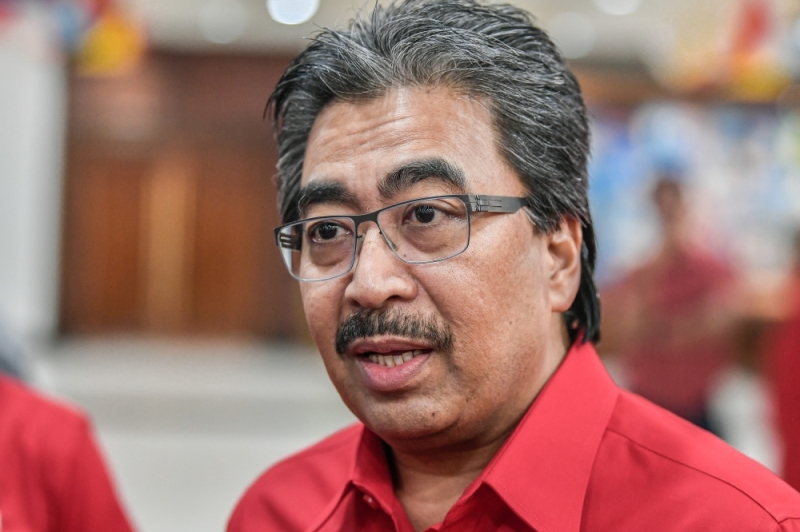

Datuk Seri Johari Abdul Ghani said that the taskforce committee was 'quite surprised' at the firm’s conduct as they had believed they were still under good faith discussions to resolve any disputes amicably. — Picture by Hari Anggara

Thursday, 12 Oct 2023 12:15 PM MYT

KUALA LUMPUR, Oct 12 — Goldman Sachs’ action of initiating arbitration proceedings may be an attempt to detract and divert attention away from their obligation to pay US$250 million (RM1.18 billion) as part of their previously agreed settlement, said 1Malaysia Development Bhd (1MDB) taskforce chairman Datuk Seri Johari Abdul Ghani.

He said that the taskforce committee was “quite surprised” at the firm’s conduct as they had believed they were still under good faith discussions to resolve any disputes amicably.

“However, in light of recent events, the government of Malaysia will be preparing to respond to this matter and ensuring that this process is done diligently and in accordance with the established legal frameworks while ensuring that the interest of the Malaysian people is safeguarded,” he said in a statement here today.

Giving a full chronology of events, he said that the government had come to an agreement with Goldman Sachs on August 18, 2020 where a cash payment of US$2.5 billion was to be paid 10 days from signing of the settlement agreement; and asset recovery amounting to US$1.4 billion by Goldman Sachs within five years from the date of the settlement agreement.

If Malaysia had not recovered US$500 million by August 18, 2022 (two years from the signing of the settlement agreement), Goldman Sachs would be required to pay US$250 million as interim payment.

Goldman Sachs disputed the accounting a year ago that claimed Malaysia had not recovered US$500 million and both parties entered into good faith discussions which were supposed to last for three months but were extended four times.

The last extension was given on August 8, 2023, and this is set to expire on November 8, 2023 (4th extension).

“The current deadline for the latest extension expires on November 8, 2023, and if a settlement is not reached between the parties by this deadline, then the government of Malaysia can commence arbitration proceedings in respect of the Interim Payment of US$250 million.

“At this juncture, parties are still considered to be in the Amicable Good Faith Discussions stage and therefore as an aggrieved party, the 1MDB Taskforce views Goldman Sachs’ initiation of arbitration proceedings as premature and without due consideration of necessary prerequisites,” said Johari.

Earlier today, it was reported that Goldman Sachs is suing Malaysia in a United Kingdom court over the settlement amount.

A spokesman for the firm said they filed for arbitration against Malaysia for violating its obligations to appropriately credit assets in the settlement agreement to recover assets.

The complaint was filed yesterday in the London International Court of Arbitration.

Thursday, 12 Oct 2023 12:15 PM MYT

KUALA LUMPUR, Oct 12 — Goldman Sachs’ action of initiating arbitration proceedings may be an attempt to detract and divert attention away from their obligation to pay US$250 million (RM1.18 billion) as part of their previously agreed settlement, said 1Malaysia Development Bhd (1MDB) taskforce chairman Datuk Seri Johari Abdul Ghani.

He said that the taskforce committee was “quite surprised” at the firm’s conduct as they had believed they were still under good faith discussions to resolve any disputes amicably.

“However, in light of recent events, the government of Malaysia will be preparing to respond to this matter and ensuring that this process is done diligently and in accordance with the established legal frameworks while ensuring that the interest of the Malaysian people is safeguarded,” he said in a statement here today.

Giving a full chronology of events, he said that the government had come to an agreement with Goldman Sachs on August 18, 2020 where a cash payment of US$2.5 billion was to be paid 10 days from signing of the settlement agreement; and asset recovery amounting to US$1.4 billion by Goldman Sachs within five years from the date of the settlement agreement.

If Malaysia had not recovered US$500 million by August 18, 2022 (two years from the signing of the settlement agreement), Goldman Sachs would be required to pay US$250 million as interim payment.

Goldman Sachs disputed the accounting a year ago that claimed Malaysia had not recovered US$500 million and both parties entered into good faith discussions which were supposed to last for three months but were extended four times.

The last extension was given on August 8, 2023, and this is set to expire on November 8, 2023 (4th extension).

“The current deadline for the latest extension expires on November 8, 2023, and if a settlement is not reached between the parties by this deadline, then the government of Malaysia can commence arbitration proceedings in respect of the Interim Payment of US$250 million.

“At this juncture, parties are still considered to be in the Amicable Good Faith Discussions stage and therefore as an aggrieved party, the 1MDB Taskforce views Goldman Sachs’ initiation of arbitration proceedings as premature and without due consideration of necessary prerequisites,” said Johari.

Earlier today, it was reported that Goldman Sachs is suing Malaysia in a United Kingdom court over the settlement amount.

A spokesman for the firm said they filed for arbitration against Malaysia for violating its obligations to appropriately credit assets in the settlement agreement to recover assets.

The complaint was filed yesterday in the London International Court of Arbitration.

No comments:

Post a Comment