Study: RM6,890 monthly budget if married with two kids in Klang Valley; RM4,700 to RM6,900 to start family in Malaysia

As a married couple in the Klang Valley without children, the majority or nearly 64 per cent of the minimum RM4,630 monthly budget is taken up by just housing (RM1,000), transportation (RM990), food (RM960), with the rest being utilities (RM310), discretionary expenses (RM300), ad-hoc or one-off spending (RM300), social participation (RM200), personal care (RM100), healthcare (RM70) and RM400 set aside for personal savings. — Picture by Shafwan Zaidon

Thursday, 15 Jun 2023 10:24 AM MYT

KUALA LUMPUR, June 15 — If you are married with two children, the most expensive area to raise your family in Malaysia would be in the Klang Valley at RM6,890 every month, and over RM6,000 at Georgetown in Penang, Seremban in Negeri Sembilan and Johor Baru in Johor, a new spending guide has shown.

In the Belanjawanku 2022/2023 spending guide commissioned by the Employees Provident Fund (EPF) that looks at 12 cities, the Klang Valley (covering urban families in Kuala Lumpur, Putrajaya and Selangor) is consistently the most expensive place to be a married couple, even if you have only one child (minimum monthly budget of RM5,980) or if you have no children (RM4,630 minimum per month).

In the same study carried out by Universiti Malaya’s Social Wellbeing Research Centre (SWRC), Georgetown is also consistently the second-most expensive city to be a married couple with two children (RM6,370), with one child (RM5,640), or no children (RM4,360).

This is followed by Seremban (married with two children at RM6,130, one child at RM5,400, no children at RM4,170), while Johor Bahru follows closely behind at RM6,100, RM5,360 and RM4,110 for the same categories.

Across all categories, Alor Setar in Kedah is the cheapest city to be a married couple, based on the estimated minimum monthly spending of RM5,430 (two children), RM4,760 (one child), and RM3,680 (no children).

Comparing Klang Valley and Alor Setar, a married couple would save at least RM1,460 if they live with two children in the city in Kedah, RM1,220 if they have one child, and RM950 if they have no children.

Why is it so expensive to be a married couple in the Klang Valley?

1. Without children

As a married couple in the Klang Valley without children, the majority or nearly 64 per cent of the minimum RM4,630 monthly budget is taken up by just housing (RM1,000), transportation (RM990), food (RM960), with the rest being utilities (RM310), discretionary expenses (RM300), ad-hoc or one-off spending (RM300), social participation (RM200), personal care (RM100), healthcare (RM70) and RM400 set aside for personal savings.

This is based on assumptions that a couple or families would rent or own a three-bedroom housing unit with calculations then based on market prices or loan instalments; and that couples would own a car with a 1,000cc engine on a nine-year loan and a motorcycle with a 125cc engine on a five-year loan along with costs for petrol, maintenance, parking, highway tolls.

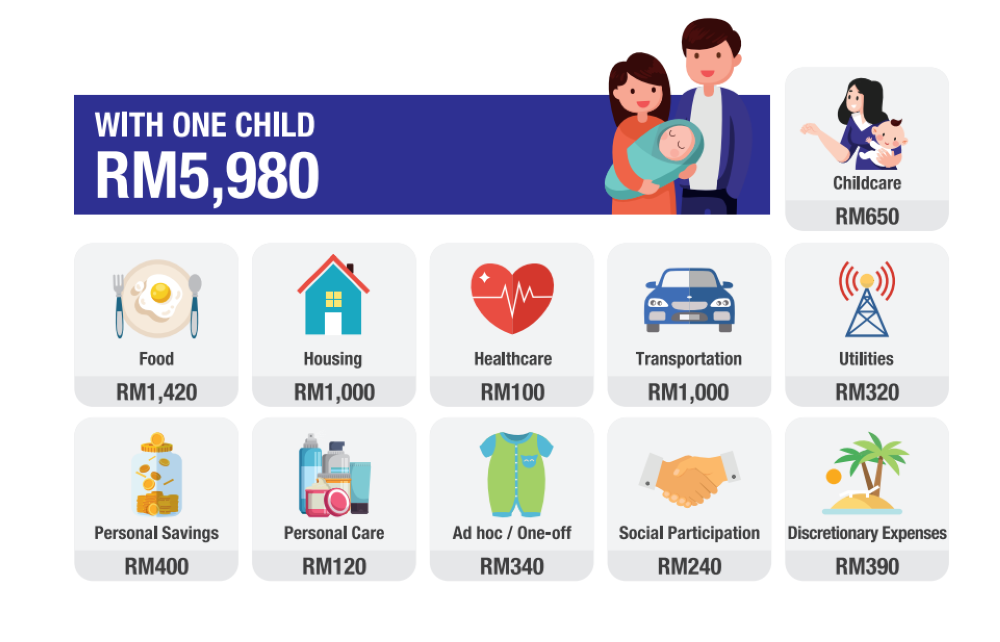

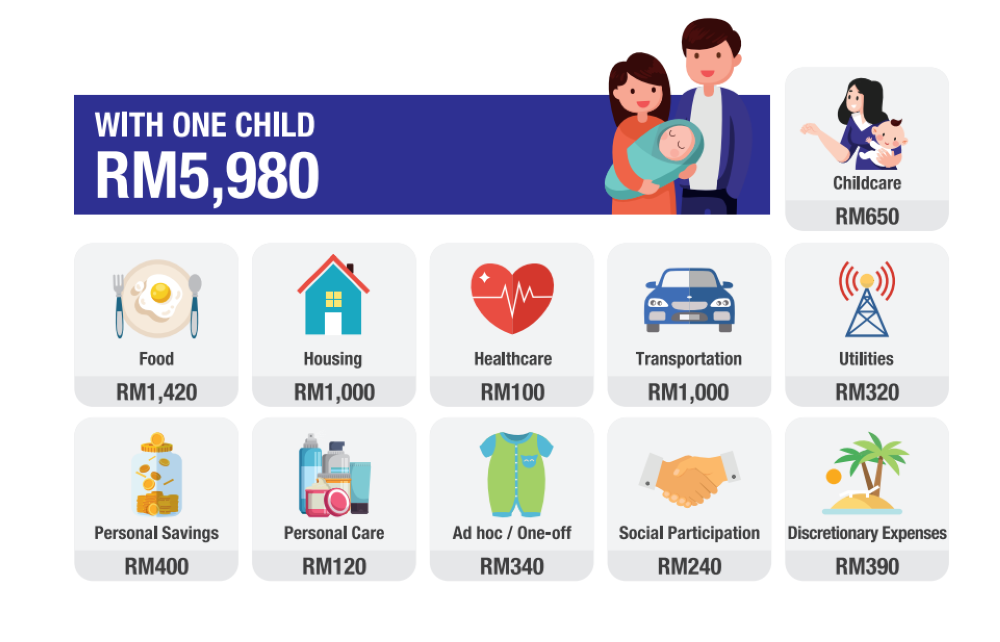

2. One child

For a married couple in the Klang Valley with one child, their total monthly budget would go up by at least RM1,350 to hit RM5,980.

The biggest bump up to the bill is childcare costs at RM650 or over 10 per cent of the monthly budget, which together with food (RM1,420), housing (RM1,000), transportation (RM1,000) would make up a combined 68 per cent of the total spending.

Having one child would result in a slight increase in most other categories of spending, such as an additional RM90 for discretionary spending, an extra RM40 each for ad-hoc spending and social participation, RM30 more (healthcare), RM20 more (personal care), RM10 more (utilities).

This assumes that a child in such families would be below six years old, where childcare costs would be pricier than for a child aged six and above. The calculations of RM650 in the Klang Valley would include costs of clothing, footwear, babysitting, diapers, milk, and baby food.

In its report on the spending guide, SWRC said the total expenses for a couple with one child in the Klang Valley is higher than other cities, and that this was expected as it has more expensive day care costs and tuition fees.

Thursday, 15 Jun 2023 10:24 AM MYT

KUALA LUMPUR, June 15 — If you are married with two children, the most expensive area to raise your family in Malaysia would be in the Klang Valley at RM6,890 every month, and over RM6,000 at Georgetown in Penang, Seremban in Negeri Sembilan and Johor Baru in Johor, a new spending guide has shown.

In the Belanjawanku 2022/2023 spending guide commissioned by the Employees Provident Fund (EPF) that looks at 12 cities, the Klang Valley (covering urban families in Kuala Lumpur, Putrajaya and Selangor) is consistently the most expensive place to be a married couple, even if you have only one child (minimum monthly budget of RM5,980) or if you have no children (RM4,630 minimum per month).

In the same study carried out by Universiti Malaya’s Social Wellbeing Research Centre (SWRC), Georgetown is also consistently the second-most expensive city to be a married couple with two children (RM6,370), with one child (RM5,640), or no children (RM4,360).

This is followed by Seremban (married with two children at RM6,130, one child at RM5,400, no children at RM4,170), while Johor Bahru follows closely behind at RM6,100, RM5,360 and RM4,110 for the same categories.

Across all categories, Alor Setar in Kedah is the cheapest city to be a married couple, based on the estimated minimum monthly spending of RM5,430 (two children), RM4,760 (one child), and RM3,680 (no children).

Comparing Klang Valley and Alor Setar, a married couple would save at least RM1,460 if they live with two children in the city in Kedah, RM1,220 if they have one child, and RM950 if they have no children.

Why is it so expensive to be a married couple in the Klang Valley?

1. Without children

As a married couple in the Klang Valley without children, the majority or nearly 64 per cent of the minimum RM4,630 monthly budget is taken up by just housing (RM1,000), transportation (RM990), food (RM960), with the rest being utilities (RM310), discretionary expenses (RM300), ad-hoc or one-off spending (RM300), social participation (RM200), personal care (RM100), healthcare (RM70) and RM400 set aside for personal savings.

This is based on assumptions that a couple or families would rent or own a three-bedroom housing unit with calculations then based on market prices or loan instalments; and that couples would own a car with a 1,000cc engine on a nine-year loan and a motorcycle with a 125cc engine on a five-year loan along with costs for petrol, maintenance, parking, highway tolls.

2. One child

For a married couple in the Klang Valley with one child, their total monthly budget would go up by at least RM1,350 to hit RM5,980.

The biggest bump up to the bill is childcare costs at RM650 or over 10 per cent of the monthly budget, which together with food (RM1,420), housing (RM1,000), transportation (RM1,000) would make up a combined 68 per cent of the total spending.

Having one child would result in a slight increase in most other categories of spending, such as an additional RM90 for discretionary spending, an extra RM40 each for ad-hoc spending and social participation, RM30 more (healthcare), RM20 more (personal care), RM10 more (utilities).

This assumes that a child in such families would be below six years old, where childcare costs would be pricier than for a child aged six and above. The calculations of RM650 in the Klang Valley would include costs of clothing, footwear, babysitting, diapers, milk, and baby food.

In its report on the spending guide, SWRC said the total expenses for a couple with one child in the Klang Valley is higher than other cities, and that this was expected as it has more expensive day care costs and tuition fees.

Screengrab from Belanjawanku 2022/2023 of estimated monthly budget for a married couple with one child in the Klang Valley

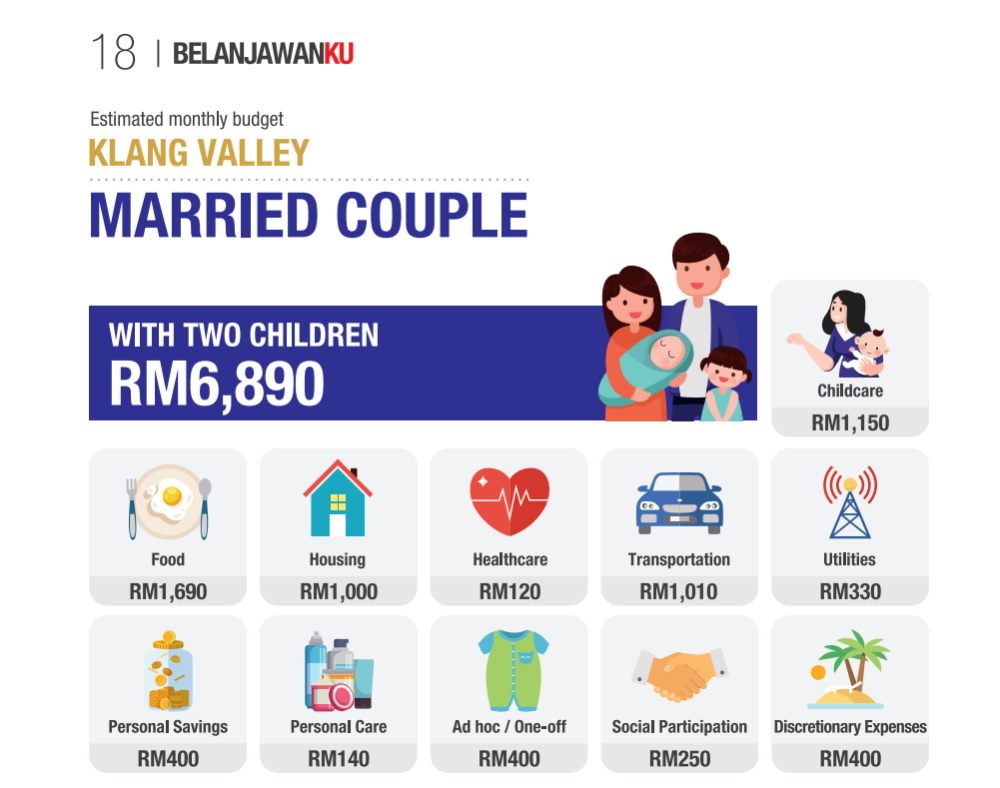

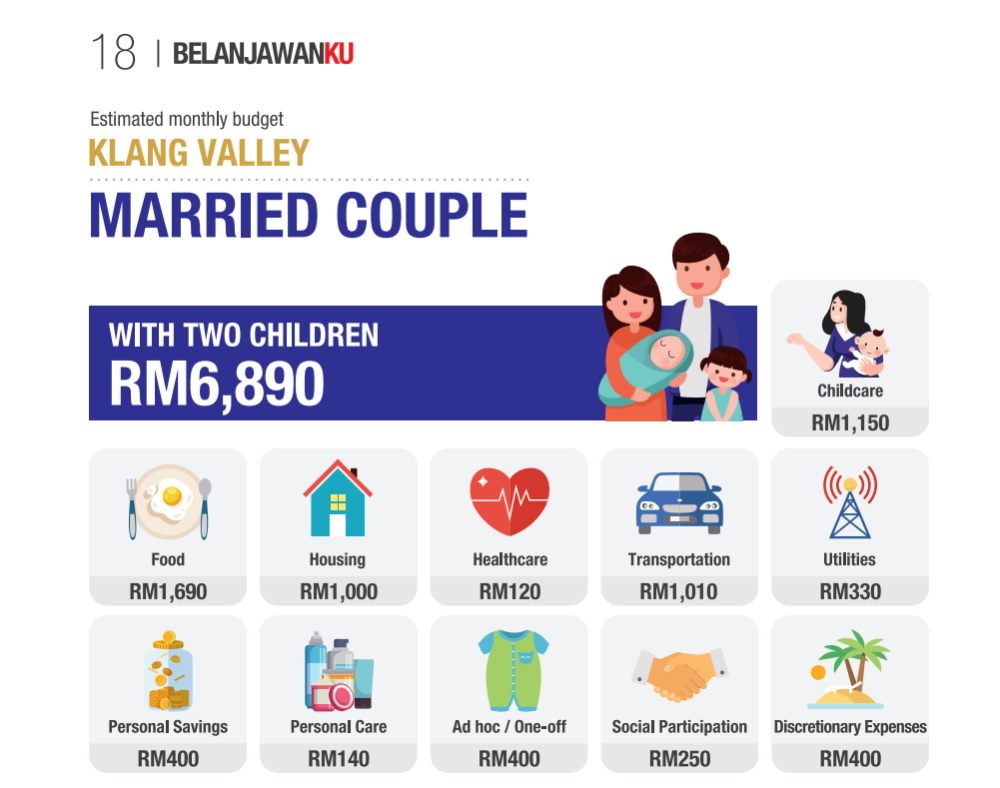

3. Two children

If you are a couple with two children in the Klang Valley, your total monthly budget will go up by RM910 at least to hit RM6,890.

Most of the monthly budget or about 70 per cent would just be for food (RM1,690), childcare (RM1,150), transportation (RM1,010), housing (RM1,000).

Based on the estimates, there would be slight increases in spending across the board when compared to a one-child scenario, such as an additional RM60 (ad-hoc spending), RM20 (healthcare; personal care) and RM10 more (utilities; social participation; discretionary expenses).

For a couple with two children in the Klang Valley, childcare costs at RM1,150 would still be the biggest increase when compared to that for a one-child scenario at RM650.

The study’s estimate assumes that the older child would need lower day care costs as more time would be spent in school.

The RM650 childcare cost assumption for an older child aged seven to 13 would include school pocket money, school bus fare and tuition fee for extra classes or religious classes; while the assumed childcare spending for the younger child would be RM500 in the Klang Valley.

3. Two children

If you are a couple with two children in the Klang Valley, your total monthly budget will go up by RM910 at least to hit RM6,890.

Most of the monthly budget or about 70 per cent would just be for food (RM1,690), childcare (RM1,150), transportation (RM1,010), housing (RM1,000).

Based on the estimates, there would be slight increases in spending across the board when compared to a one-child scenario, such as an additional RM60 (ad-hoc spending), RM20 (healthcare; personal care) and RM10 more (utilities; social participation; discretionary expenses).

For a couple with two children in the Klang Valley, childcare costs at RM1,150 would still be the biggest increase when compared to that for a one-child scenario at RM650.

The study’s estimate assumes that the older child would need lower day care costs as more time would be spent in school.

The RM650 childcare cost assumption for an older child aged seven to 13 would include school pocket money, school bus fare and tuition fee for extra classes or religious classes; while the assumed childcare spending for the younger child would be RM500 in the Klang Valley.

Screengrab from Belanjawanku 2022/2023 of estimated monthly budget for a married couple with two children in the Klang Valley

Are you planning to start a family in Malaysia?

Wondering what all these numbers mean?

The Belanjawanku spending guide is not meant to be a “standard” that you must follow or a solution for your financial problems, but it is just to provide reference on estimated monthly expenses to help you plan your finances.

It will let you know how much money you need to have a “reasonable standard of living”, which is enough to pay for your basic needs, be involved in your community and with your families and friends, while also living a purposeful and meaningful life.

It could even help you see whether it is worth moving from the Klang Valley to another city with your family.

For example, a couple relocating from the Klang Valley to Georgetown would only see savings of between six to seven per cent (RM270 to RM520) for their monthly budget, compared to shifting to Alor Setar where the budget is expected to be lower by 20 to 21 per cent (RM950 to RM1,460).

Looking at just the Klang Valley, it could also help Malaysians make informed decisions before they make the big decision to start a family, to estimate how much more is needed every time a new member is added to the household.

For example, a single person who is a car owner in the Klang Valley would need an estimated RM2,600 each month, but this will go up by 78 per cent if they are married, and would go up by another 29 per cent if the couple has a child, while having a second child will push up the monthly budget by another 15 per cent more.

Read here for the Belanjawanku 2022-2023 summary, and here for the full report on the spending guide.

Are you planning to start a family in Malaysia?

Wondering what all these numbers mean?

The Belanjawanku spending guide is not meant to be a “standard” that you must follow or a solution for your financial problems, but it is just to provide reference on estimated monthly expenses to help you plan your finances.

It will let you know how much money you need to have a “reasonable standard of living”, which is enough to pay for your basic needs, be involved in your community and with your families and friends, while also living a purposeful and meaningful life.

It could even help you see whether it is worth moving from the Klang Valley to another city with your family.

For example, a couple relocating from the Klang Valley to Georgetown would only see savings of between six to seven per cent (RM270 to RM520) for their monthly budget, compared to shifting to Alor Setar where the budget is expected to be lower by 20 to 21 per cent (RM950 to RM1,460).

Looking at just the Klang Valley, it could also help Malaysians make informed decisions before they make the big decision to start a family, to estimate how much more is needed every time a new member is added to the household.

For example, a single person who is a car owner in the Klang Valley would need an estimated RM2,600 each month, but this will go up by 78 per cent if they are married, and would go up by another 29 per cent if the couple has a child, while having a second child will push up the monthly budget by another 15 per cent more.

Read here for the Belanjawanku 2022-2023 summary, and here for the full report on the spending guide.

No comments:

Post a Comment