Where’s NADMA’s RM150 Million? – It’s Illegal To Channel RM10 Millions Of EPF Members’ Money To Dubious NGOs

Donations and charities have often been misused and abused by certain individuals and organizations to do bad things like money laundering, tax evasion, tax fraud and whatnot. Just ask former Prime Minister Ahmad Zahid Hamidi how his families hid behind charity foundation Yayasan Akalbudi and used dirty money to go on shopping sprees at luxury stores.

As thousands of Malaysians were glued to the massive floods that plagued the country about a week before the Christmas, a decision by the EPF (Employees Provident Fund) to allocates RM10 million for flood relief and welfare aid has largely gone unnoticed. After all, during the time of a crisis, any types of donations and charities will be welcomed – rarely questioned.

The amount may look small compared to the retirement fund’s 14.6 million members, of which 7.6 million were active contributors. It was like taking away RM0.70 from each member to help the flood victims. No big deal, right? Well, it may not look a lot to the 14.6 million KWSP / EPF members, but it’s a huge amount if the money was diverted to just a handful of crooks.

The EPF said the RM10 million will be channelled through NGOs (Non-Government Organizations) without specifically naming them. The lack of transparency is definitely worrying at a time when the unelected government spends public funds as if there’s no tomorrow, not to mention how the disgraced former Prime Minister Najib Razak stole the people’s money.

More importantly, can Finance Minister Tengku Zafrul unilaterally order KWSP / EPF to channel the money, which belongs to its contributors in the first place, to dubious NGOs under the pretext of donation? How do we know the RM10 million will reach safely 100% in the hands of the flood victims and not “leaked”, leaving only 10% or RM1 million for the people (if it ever reach the people at all)?

Nowhere in the EPF Act 1991 that says it can happily donate members’ money to any organizations without approval, either from the contributors or the board. Knowing the inefficiency of the government, it was impossible that the necessary approvals were in order when the finance minister announced the RM10 million donation on Sunday (Dec 19), just 2 days after the flash flood hit on Friday (Dec 17).

Section 26 of the EPF Act 1991 says the Board is empowered to invest moneys belonging to the retirement fund in financial institutions, stock markets, and bonds. Channelling money to NGOs, even for donations or charities, is not an investment, which clearly is illegal as far as the EPF Act is concerned. Allocating RM10 million for flood relief programmes is giving away the money without expecting any ROI (return on investment).

It’s easy for politicians or incompetent finance minister like Zafrul to misuse EPF contributors’ hard-earned money for selfish political mileage. But EPF is not like GLCs (Government-Linked Companies) such as Telekom Malaysia, Tenaga Nasional, Petronas, Celcom, Malaysia Airlines or RHB Bank, because the source of funds is money from members – nothing to do with the government.

In fact, KWSP / EPF and Permodalan Nasional Berhad (PNB) are not even GLICs (Government-Linked Investment Companies), let alone GLCs. Examples of true GLICs are Khazanah Nasional Berhad (KNB) and Retirement Fund Inc (KWAP) as the money being managed by these two entities were derived from excessive funds from the government.

There’s a difference between an investment, a bailout and a haircut. But after decades of corruptions, abuse of power and irregularities, largely because ignorant voters had voted the same Barisan Nasional coalition as the government for more than 60 years since independence in 1957 (till its stunning defeats in the May 2018 General Election), people can’t tell what EPF can or cannot do.

At most, Section 26 of EPF Act 1991 allows the Board to provide “loans” to the Government of Malaysia or the State Government. Still, a loan does not mean donation or aid to flood victims. And it is here where corrupt politicians like Mr Najib had manipulated and exploited the “provision of loans” to steal money from entities like KWAP, the largest public service pension fund.

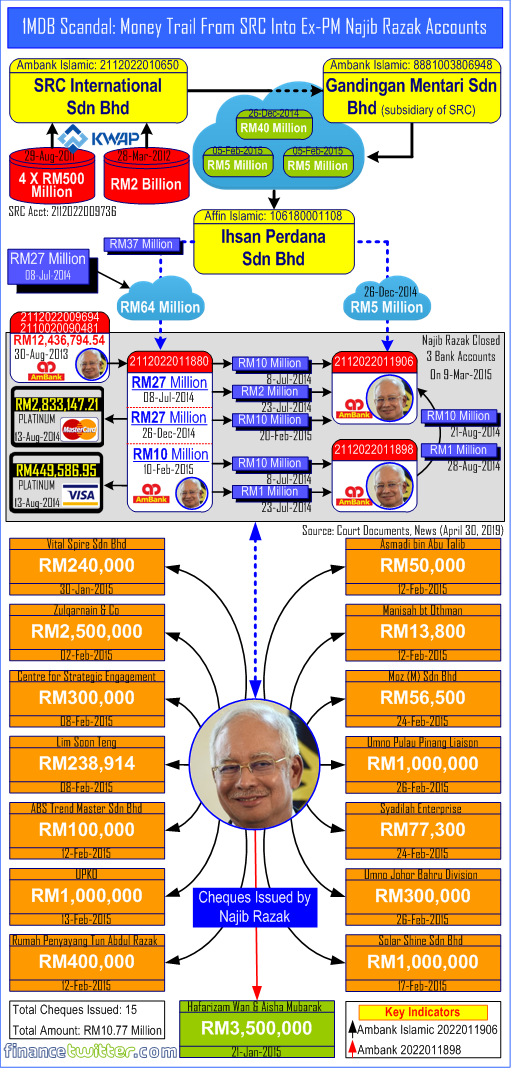

The 1MDB scandal was nothing but a scam when Najib (then-PM and Finance Minister) and his partner-in-crime Jho Low hatched a dubious business plan to develop renewable energy in order to justify a RM4 billion loan from KWAP to SRC International Sdn Bhd (a subsidiary of 1MDB). After the loan was disbursed in 2011 and 2012, the money was siphoned out to Switzerland instead.

During the recent Court of Appeal’s verdict, all the three senior judges were convinced that Najib was the big boss behind SRC because only a prime minister cum finance minister had the power to instruct the SRC board to divert funds, included RM42 million transferred into Najib’s personal bank account (which received a total of RM606.51 million over 19 months).

In the same breath, it could be yet another scam, albeit at a smaller scale, when finance minister Zafrul ordered EPF to disburse RM10 million to NGOs disguised to help flood victims. People in general don’t see any issue because RM10 million is like chicken feed compared to RM4 billion. This is what Najib called national interest, but rubbished by the Court of Appeal as “national embarrassment”.

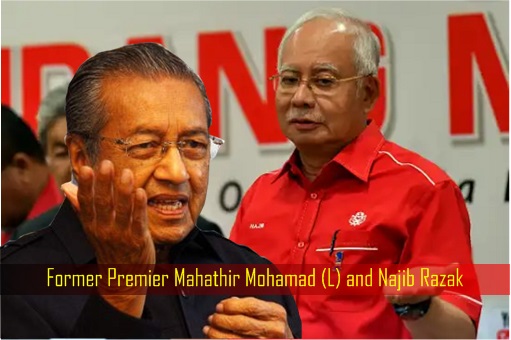

Knowing very well that a loan could also be a bad loan that would translate into negative ROI, the corrupt government of Barisan Nasional has been abusing the provision in Section 26 of EPF Act 1991 to bail out cronies and families for decades. For example, during the 1997-1998 Asia Financial Crisis, PM Mahathir formed a RM60 billion fund, sourced mainly from EPF, to bail out tons of cronies.

As Mahathir’s privatization crumbled under the weight of incompetence, corruption and mismanagement during the crisis, companies owned by cronies like national sewerage concessionaire Indah Water Konsortium (IWK) was given soft “irrecoverable” loan amounted to RM1.4 billion, while MAS (Malaysia Airlines System) was also bailed out as the national airlines sat on a RM9.5 billion debt.

National carmaker Proton, which reported losses for so many years that people had lost count, was repeatedly bailed out so that Mahathir’s pet project would not go belly-up. EPF suffered RM100 million losses when it was forced to cough up RM269.28 million on 81.6 million unsubscribed Time dotCom shares at RM3.30 – when the share was hovering between RM1.96 to RM2.10.

After raising RM6 billion bond to rescue light-rail transit operators PUTRA (Projek Usahasama Transit Ringan Automatik Sdn Bhd), which had defaulted its RM2 billion loan in 1999, the EPF was ordered to give RM600 million in yet another soft “irrecoverable” loan to STAR (Sistem Transit Aliran Ringan Sdn Bhd) simply because the companies belonged to Renong Bhd (UMNO’s former investment arm).

Other companies that enjoyed mega bailouts, just to name a few, included UEM, Malayan Banking, Bank Bumiputra, Sime Bank, KUB, Bank of Commerce, RHB Bank, Ekran’s Bakun Dam Project, Park May-Intrakota bus, Monorail, and even Konsortium Perkapalan Bhd – owned by Mahathir’s son Mirzan whose brilliant business acumen saw the company submerged in debts as much as RM1.7 billion.

Under then-Finance Minister Najib Razak, EPF money to the tune of RM5 billion was used to rescue an extremely useless ValueCap Sdn Bhd, a so-called state-owned investment house which was backed by Khazanah, KWAP and PNB. ValueCap was established in 2002 as a Malaysian version of Hong Kong’s Tracker Fund. However, copycat ValueCap failed spectacularly to make money.

The Covid-19 pandemic saw how EPF, which was initially used as a cash cow to bail out government-linked companies due to corruption and mismanagement, becomes an ATM machine to withdraw money whenever the clueless and incompetent government fails to solve economic problems. Schemes like i-Lestari, i-Sinar and i-Citra allowed contributors to prematurely empty their own retirement savings.

It has reached a dangerous stage when a very racist and corrupted UMNO leader, Tajuddin Abdul Rahman, suggested that EPF money should be used to help Malay or Bumiputera entrepreneurs or companies. Heck, the UMNO leaders have even called for another round of EPF withdrawal for flood victims, a lazy and shortcut solution to pacify angry voters who have publicly condemned Ismail Sabri administration.

From abusing EPF money to rescue cronies to misusing the retirement funds to bail out the government’s failure in business and investment ventures, now the finance ministry has resorted to taking members’ money without asking and diverts it to unknown NGOs. Why can’t the government channel the money from the National Disaster Management Agency (NADMA) to the NGOs?

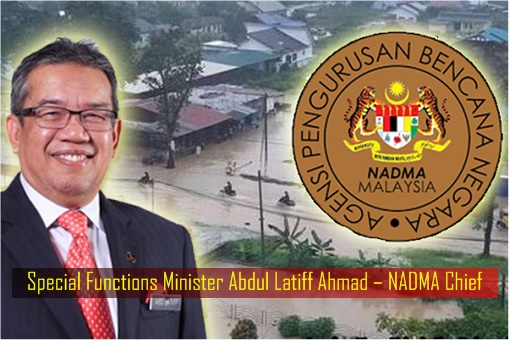

After all, NADMA received a jaw-dropping allocation of RM150 million under Budget 2021, up from RM129 million in the previous year. Based on the agency chief Abdul Latiff Ahmad recent argument that Nadma only had 50 staffs, what has happened to the unused funds of RM129 million allocated in 2020 since there was no serious disaster in that year?

And since special functions minister Abdul Latiff Ahmad also said that his agency only manages victim compensation – not disaster management or coordination – should not finance minister Zafrul divert money from NADMA to NGOs instead? It’s definitely wrong and illegal to channel money from EPF because NADMA is the correct agency to provide financial aid – either to the victims or NGOs.

In hindsight, Mahathir's decision to bailout the Star and Putra LRT networks was the correct decision in the National Interest.

ReplyDeleteAdhering to conventional economics would have been to leave market forces to allow the two companies to collapse and their creditors and bondholders to seize their assets and sell it off. All that would have been left behind would be decaying and useless concrete pillars.

Today, what was originally the STAR and Putra LRT networks remain the indispensable core of the Klang Valley mass transit system.

It is a very sad but true story of a Malaysia run by individuals out to line their own pockets.

ReplyDeleteThe rakyat is dangerously becoming inured to seeing corrupt politicians maximised their positions for their own personal benefit.

I hope and pray that we do not always say "biasa-lah" when a scandal about corruption breaks out.

The plying of the EPF coffer starts NOW!

ReplyDeleteNEVER in the past ketuanan history have these dickheads DARE to source free fund outwardly from EPF.

All those past hand-in-the-kitty financial 'headtricks' were in the form of loans. Never as DONATION!

Besides, the EPF is NEVER governed under the portfolio of the finance ministry. Based on what jurisdiction could that f*cked Zafrul ordered EPF to disburse RM10 million to NGOs - disguised to help flood victims?

What would this mfer do to prevent a run when those major EPF contributors start to withdraw their money from the EPF accounts.

Despite all the 'roadblocks' setting in place to prevent such occurrence, never have these cbmfers ever realise that those major contributors r all passed their retirement age such that they can LEGALLY withdraw their whole EPF savings in one go!

& their EPF savings constitute a very large portion of the EPF total fund size!