P Gunasegaram

Published: Aug 1, 2025 8:03 AM

Updated: 10:03 AM

COMMENT | When information is lacking, it is a sign that not all is right. Tanjong Karang MP Zulkafperi Hanapi, obviously piqued by a drop in the Employees Provident Fund’s (EPF) income, asked in Parliament whether it was tied to its overseas assets.

Good question. But the written answer he got was the same stock reply that the EPF gave in June when it announced the first quarter performance for 2025.

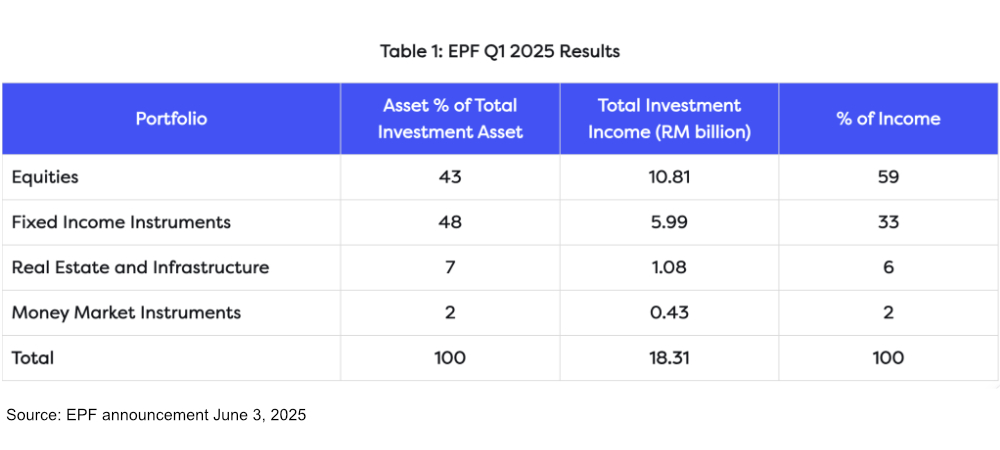

Total income declined 13 percent to RM18.31 billion, and equity income, accounting for six tenths of total income, declined by 23 percent to RM10.81 billion.

The media reported the written reply by the Finance Ministry: “The weaker performance was largely driven by rising global trade tensions and the unpredictable trade policies of the United States.

“The ministry said the impact of current market conditions was reflected in EPF’s equity investment returns, which fell by two percent to RM10.81 billion in 1Q 2025, from RM14.02 billion in 1Q 2024.”

Published: Aug 1, 2025 8:03 AM

Updated: 10:03 AM

COMMENT | When information is lacking, it is a sign that not all is right. Tanjong Karang MP Zulkafperi Hanapi, obviously piqued by a drop in the Employees Provident Fund’s (EPF) income, asked in Parliament whether it was tied to its overseas assets.

Good question. But the written answer he got was the same stock reply that the EPF gave in June when it announced the first quarter performance for 2025.

Total income declined 13 percent to RM18.31 billion, and equity income, accounting for six tenths of total income, declined by 23 percent to RM10.81 billion.

The media reported the written reply by the Finance Ministry: “The weaker performance was largely driven by rising global trade tensions and the unpredictable trade policies of the United States.

“The ministry said the impact of current market conditions was reflected in EPF’s equity investment returns, which fell by two percent to RM10.81 billion in 1Q 2025, from RM14.02 billion in 1Q 2024.”

Astute readers will see that the decline in equity income was wrongly reported - it’s not two percent but 23 percent.

Markets declined by less

That’s nearly a quarter drop in investment income, but crucially, markets did not decline anywhere near that.

The MSCI World Index Global Development declined just 0.9 percent, and the MSCI Global All Cap by just 1.61 percent. In the US, the S&P declined 4.3 percent and the Dow Jones slid 10.5 percent. But the MSCI EMU index, reflecting the Eurozone, rose over 11 percent.

The major decline was Japan, with the Nikkei 225 down over 14 percent. The Malaysian market declined by just 7.8 percent, a third of the 23 percent drop in EPF’s equity income.

The mystery: why did equity income decline so much more? Broadly speaking, the EPF has two accounts - investment and trading. For investment, the EPF can recognise dividend income and any permanent increase in the value of investments.

For the trading account, gains and losses must be recognised as incurred and dividend income received can be recognised as well.

Did EPF incur unexpected losses?

Since the markets have not declined as much as 23 percent, it is fair to infer that the EPF has incurred unexpected losses in some of these areas. But it does not disclose any of these in its announcement.

Were there any large transactions that lost money? How, why and when did it happen? Was there any way it could have been avoided? How did the trading account do? Were there large provisions for diminution in value? These are some questions.

In the announcement on June 3, EPF CEO Ahmad Zulqarnain Onn said: “Global markets turned volatile early in 2025 on renewed trade frictions and policy uncertainty.

“Whilst the announcement of tariffs was made by the US administration on April 2, uncertainties surrounding US trade policies had begun to affect major stock markets throughout the quarter.

“Despite the moderation of inflationary pressures in many economies, the pace and timing of monetary policy easing differed across regions, dampening risk appetites. Our diversified global portfolio cushioned the impact and kept the EPF on course for long-term value creation.”

EPF CEO Ahmad Zulqarnain Onn

The announcement further said: “During the quarter under review, Equities contributed RM10.81 billion, a 23 percent decline from RM14.02 billion recorded in Q1 2024.

“The drop was mainly due to weaker performance across global equity markets and a challenging investment climate. The asset class continued to be the highest contributor, accounting for 59 percent of total investment income.”

EPF’s deafening silence

As we saw, weaker performance across global markets could not have accounted for the steeper fall in EPF’s equity income - perhaps “a challenging investment climate” is more responsible. Lamentably, EPF is silent, giving rise to much needless speculation. Instead, it’s chosen to limit information and enlightenment.

To add fuel to speculation, the RM18.31 billion total investment income for the first quarter includes RM1.02 billion as mark-to-market gains on securities not yet realised, due to foreign exchange rate fluctuations. In line with the EPF’s policy, these gains will not be distributable as dividends.

Consequently, the investment income falls to an effective RM17.29 billion, deepening the decline to 18 percent (rather than 13 percent) from the RM21 billion reported by EPF for the previous quarter.

All these, if left alone, can lead to undue speculation over the state of affairs at EPF that neither EPF and the government, on one hand, nor the EPF members, on the other, want to perpetuate and prolong.

The only way to avoid this is to provide full information. From the time of its inception in 1951, EPF, one of the world’s oldest and largest pension funds, has been cagey about giving full information, citing competitive and market factors.

Outdated, archaic excuse

That is an outdated and archaic excuse which needs to be discarded forthwith, partly caused by the government’s historical “interfering hands” in its running through board and key managerial appointments and using that influence.

The announcement further said: “During the quarter under review, Equities contributed RM10.81 billion, a 23 percent decline from RM14.02 billion recorded in Q1 2024.

“The drop was mainly due to weaker performance across global equity markets and a challenging investment climate. The asset class continued to be the highest contributor, accounting for 59 percent of total investment income.”

EPF’s deafening silence

As we saw, weaker performance across global markets could not have accounted for the steeper fall in EPF’s equity income - perhaps “a challenging investment climate” is more responsible. Lamentably, EPF is silent, giving rise to much needless speculation. Instead, it’s chosen to limit information and enlightenment.

To add fuel to speculation, the RM18.31 billion total investment income for the first quarter includes RM1.02 billion as mark-to-market gains on securities not yet realised, due to foreign exchange rate fluctuations. In line with the EPF’s policy, these gains will not be distributable as dividends.

Consequently, the investment income falls to an effective RM17.29 billion, deepening the decline to 18 percent (rather than 13 percent) from the RM21 billion reported by EPF for the previous quarter.

All these, if left alone, can lead to undue speculation over the state of affairs at EPF that neither EPF and the government, on one hand, nor the EPF members, on the other, want to perpetuate and prolong.

The only way to avoid this is to provide full information. From the time of its inception in 1951, EPF, one of the world’s oldest and largest pension funds, has been cagey about giving full information, citing competitive and market factors.

Outdated, archaic excuse

That is an outdated and archaic excuse which needs to be discarded forthwith, partly caused by the government’s historical “interfering hands” in its running through board and key managerial appointments and using that influence.

It’s a long history I won’t get into here, but the current government must be wary of and not make a mistake by using the funds for political purposes - it must always be professionally run with due regard to 16 million members and only them.

The one way that is possible, as in most developed markets, is full disclosure of investments by retirement funds at least on a quarterly basis.

Here’s a foreign example. The largest retirement fund in the US is CalPERS, the California public servants retirement scheme, with US$500 billion or RM2.13 trillion in money invested on behalf of more than two million members.

The EPF is more than half the size of CalPERS at RM1.26 trillion invested as of the end of March, but has eight times the number of members at over 16 million. But tellingly, CalPERS has much more public information.

Full disclosure to remove doubts

It has an annual investment report of 340 pages, detailing all its investments. Anyone can download it, and it’s only part of the information available on its very comprehensive website.

Our EPF’s annual report for 2024 is yet to be released (I could not find it on its website). While the EPF is one of the better-managed government funds and bodies, it needs full disclosure to keep interfering government hands out and to show that it is above any mischief.

Right now, these doubts that have been raised can only be cleared by the EPF, which should explain in full why its equity income collapsed by nearly a quarter when most world markets were down by less than half, and in most cases, with some even showing substantial gains.

That will silence the doubting Thomases, such as me. But continued silence by the EPF will only increase uncertainty among EPF members, of which I remain one.

One last question which will be on everyone’s minds: How much will it affect dividend income this year, given that last year’s was 6.3 percent? That’s a trillion-ringgit question deserving of an answer.

P GUNASEGARAM says full disclosure engenders confidence while paucity perpetuates doubt.

EPF last few years made some bad calls with some of its overseas investments.

ReplyDeleteThe reality of risk/rewards investments , It's a matter of you win some , you lose some.

Nothing that fundamentally risks it's core funds, as long as it does an honest review of its investment decisions.

CALPERs also made some egregiously bad investment decisions including putting funds into companies involved in military contracts to CCP's PLAAF.

ReplyDeleteQuestions were raised by retiree groups -why is CALPERS investing your pension funds in CCP companies building weapons which may someday be used against your Marine grandson ?

Wakakakaka… know-nothing mfer trying to lie about CALPERs putting funds into companies involved in military contracts to CCP's PLAAF.

DeleteMfer, shows proof lah, not just oneliner statement of inconsequential fart!

Just for a clear FACT, PLAAF doesn't engage ANY of its contractors/ suppliers with foreign links!

BTW, the writer of the report clearly distinguished the fact that the overall performances of the various oversea markets COULDN'T justfy the humongous fall in investment returns.

Saying w/o marking to the point, EPF must has done a very lousy & risky portfolio call that caused a one time huge loss.

The reality of risk/rewards investments done with MATURED investors DON'T coalescing with you win some , you lose some mentality. ESPECIALLY so, when the fund involved is pension realistic!

But how do u know with ur kind of know-nothingness!