al Jazeera:

Costlier cars? Why China’s gallium, germanium export curbs matter

Beijing’s latest salvo in a chip war with Washington could affect everything from electric vehicles to smartphones.

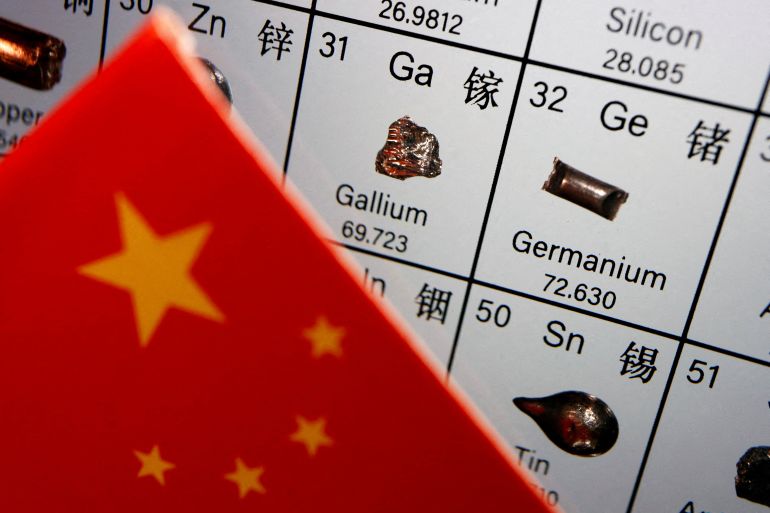

A representation showing gallium and germanium on the periodic table, with a Chinese flag in front [Florence Lo/Reuters]

Published On 12 Jul 202312 Jul 2023

China announced in early July that exporters would need approvals to send certain gallium and germanium products overseas from August 1 to “preserve security and national interests”.

The decision was just the latest move in a tense geopolitical rivalry between the United States and China that has seen both sides impose tit-for-tat measures on semiconductors and other key tech sectors.

Washington has blacklisted scores of Chinese companies to deprive them of access to US chips and other cutting-edge technologies that it says could be used to undermine its national security.

Gallium and germanium are the weapons China is using in what is the latest salvo in this increasingly tense chip war. Chinese state media have described restrictions on the exports of these rare metals as a “warning” to the US.

Published On 12 Jul 202312 Jul 2023

China announced in early July that exporters would need approvals to send certain gallium and germanium products overseas from August 1 to “preserve security and national interests”.

The decision was just the latest move in a tense geopolitical rivalry between the United States and China that has seen both sides impose tit-for-tat measures on semiconductors and other key tech sectors.

Washington has blacklisted scores of Chinese companies to deprive them of access to US chips and other cutting-edge technologies that it says could be used to undermine its national security.

Gallium and germanium are the weapons China is using in what is the latest salvo in this increasingly tense chip war. Chinese state media have described restrictions on the exports of these rare metals as a “warning” to the US.

Why are gallium and germanium important?

Gallium is produced when processing bauxite to make aluminium and is currently used in a wide variety of applications, from LEDs to smaller mobile phone adaptors.

Gallium in pure form can melt in your hand, but it has become even more sought after as a compound.

Automakers are hungry for anything that boosts the efficiency of electric vehicles and reduces weight, helping them to cut costs. Gallium nitride does both and is far cheaper than other semiconductor materials like platinum or palladium.

Germanium, a silvery-white metal, is obtained as a by-product of zinc production and is used to make optical fibres and infrared camera lenses.

China produces 60 percent of the world’s germanium and 80 percent of gallium, according to the European industry association Critical Raw Materials Alliance (CRMA).

In 2022, the top importers of China’s gallium products were Japan, Germany and the Netherlands, customs data suggests. The top importers of germanium products were Japan, France, Germany and the US.

Companies that rely on the minerals for semiconductors and electric vehicles are racing to secure supplies as fears of shortages grow.

The auto industry, in particular, is concerned by the recent developments, having only just begun recovering from a pandemic-fuelled global semiconductor shortage that forced automakers to halt production of some models and, in some cases, to leave unfinished vehicles standing waiting for a single chip.

Defence industries have also been affected. The Pentagon recently announced it had taken steps to increase domestic mining and processing of germanium and gallium — the US has no reserves of the latter.

Arun Seraphin, executive director for the National Defense Industrial Association’s Emerging Technologies Institute, told the Reuters news agency that although major defence contractors like Lockheed Martin Corp may not buy gallium and germanium directly, they likely procure semiconductors from suppliers who source Chinese gallium and germanium.

Restrictions on that supply potentially “slow down the production of DoD systems” or “ratchets up the cost”, he said.

Can China develop its own chip industry?

‘Just the start’ of US-China chip war

In October, the US unveiled a set of export controls banning Chinese companies from buying advanced chips and chip-making equipment without a licence.

The US then pushed allies and partner countries to impose restrictions on the Chinese tech industry, with the Netherlands set to introduce new export curbs aimed at China later this year.

China retailed in April when its cyberspace regulator barred key infrastructure operators from buying products made by US memory chipmaker Micron Technology Inc.

Japan and South Korea have also explored supply-chain diversification away from China as concerns about chip shortages have risen.

During a meeting with Japanese Prime Minister Fumio Kishida in May, Kyung Kye-hyun, the head of Samsung’s device solutions division, declared the South Korean company’s intention to build a research and development facility for semiconductors in Japan.

Experts believe the chip war will continue as the US and China vie for technological supremacy.

In early July, a former deputy commerce minister, Wei Jianguo, told the state-run China Daily that the latest export bans were “just the start”.

In October, the US unveiled a set of export controls banning Chinese companies from buying advanced chips and chip-making equipment without a licence.

The US then pushed allies and partner countries to impose restrictions on the Chinese tech industry, with the Netherlands set to introduce new export curbs aimed at China later this year.

China retailed in April when its cyberspace regulator barred key infrastructure operators from buying products made by US memory chipmaker Micron Technology Inc.

Japan and South Korea have also explored supply-chain diversification away from China as concerns about chip shortages have risen.

During a meeting with Japanese Prime Minister Fumio Kishida in May, Kyung Kye-hyun, the head of Samsung’s device solutions division, declared the South Korean company’s intention to build a research and development facility for semiconductors in Japan.

Experts believe the chip war will continue as the US and China vie for technological supremacy.

In early July, a former deputy commerce minister, Wei Jianguo, told the state-run China Daily that the latest export bans were “just the start”.

SOURCE: AL JAZEERA AND NEWS AGENCIES

No comments:

Post a Comment